11:35 pm CST March 30, 2017 (Pur Java Brand News) The Basket Is Full, Inc., maker of the top-selling premium coffee brand Pur Java™, announced today that it has started distributing to Natural Grocers throughout Denver, Colorado and Rochester, Minnesota, carrying six SKUs of Pur Java™ Brand. Jonathan Primo Fuego Galicia, president and chief executive officer of The Basket Is Full, Inc., commented, “We are making good progress with positioning the business to meet our long-term objectives for top and bottom line growth while delivering against our consumer-centric vision to engage, delight, and inspire our consumers through our Java Tops program. Central to our strategy is capitalizing on the strength of our leading brands such as Honduras Natural Chocolate, Ethiopia Yirgacheffe, and Rwanda. Investing in these growth initiatives requires us to continue generating fuel in the form of ongoing cost management. Our disciplined focus on controlling costs and upgrading the quality of our revenue base with new specialty products, will begin to start hitting store shelves this fall.” About Natural Grocers: About Natural Grocers by Vitamin Cottage-Natural Grocers by Vitamin Cottage, Inc. (NYSE: NGVC; NaturalGrocers.com) is a rapidly expanding specialty retailer of organic and natural groceries, body care and dietary supplements. Family-run Natural Grocers was built on the premise that consumers should have access to affordable, high-quality foods and dietary supplements, along with nutrition knowledge to help support their own health. The company offers a flexible, neighborhood-store format, affordable prices and free, science-based nutrition education programs to help customers make informed health and nutrition choices. Founded in Colorado in 1955, Natural Grocers has more than 3,000 employees and operates 132 stores in 19 states. For more information visit: https://www.naturalgrocers.com SOURCE: The Basket Is Full, Inc. Food Processing Plant Lincoln, NE 68504 www.purjava.com

0 Comments

8:00 am CST March 29, 2017 The Basket Is Full, Inc., announced today that the company's first-quarter 2017 results will be released after the close of business on Tuesday, April 10, 2017 at 4:30 p.m. (CST the same day) The Basket Is Full, Inc., will host a conference call to discuss the results. The company's earnings release, Investor Briefing and related materials will be available to all shareholders through our Investor Relations Department. *Pur Java™ products and services are provided or offered by The Basket Is Full, Inc. under the name - Pur Java Brand About The Basket Is Full, Inc. The Basket Is Full, Inc., is a privately held Food Processing Plant, located in Lincoln, NE. Our objective is to create a stable, consistent portfolio of investments through the acquisition and development of organic and specialty food products; that are of low risk potential throughout the world. Additional information about Pur Java™ products and services is available at http://www.purjava.com Follow our news on Twitter at @purjavacoffee, on Facebook at http://www.facebook.com/purjavacoffee and YouTube at http://www.youtube.com/purjavabrandnews (C) 2017 The Basket Is Full, Inc., Intellectual Property. All rights reserved. The Basket Is Full, Inc., the Globe logo and other marks are trademarks and service marks of The Basket Is Full, Inc., Intellectual Property and/or The Basket Is Full, Inc., affiliated companies. All other marks contained herein are the property of their respective owners. SOURCE: The Basket Is Full, Inc., Food Processing Facility Lincoln NE 68504, 1-800-894-8551 www.purjava.com/investorrelations TOTAL TIME: 0:22 (On Grill) PREP: 0:20 LEVEL: Easy SERVES: 4 Ingredients

Directions

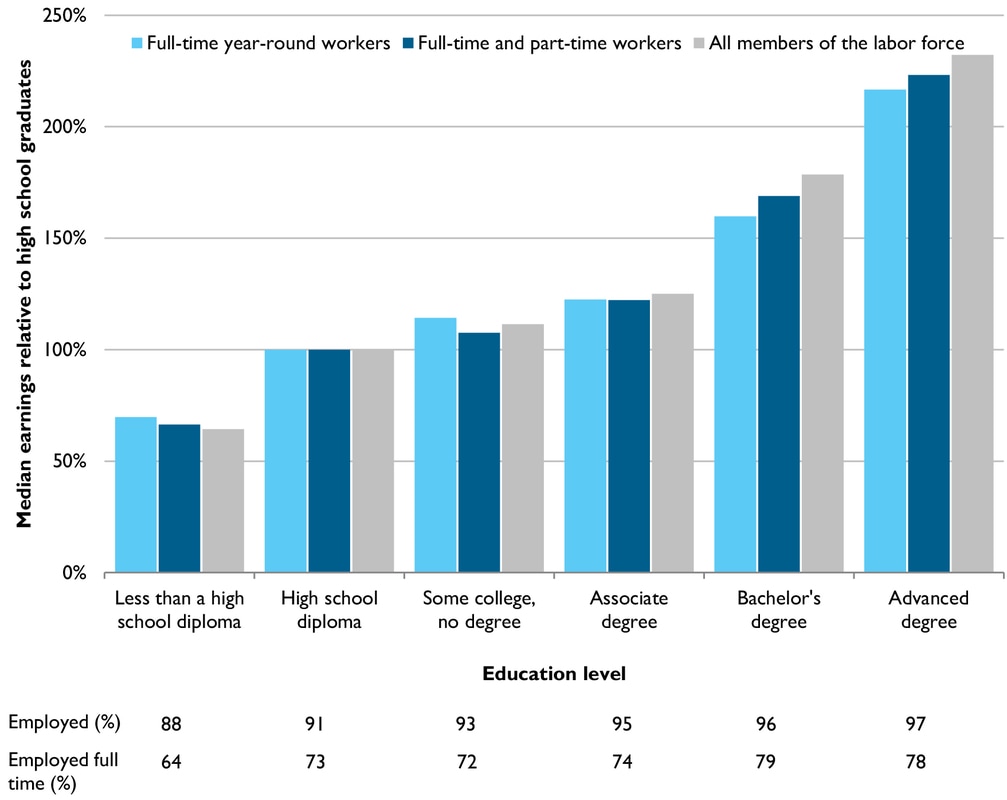

LINCOLN, NE More than one-quarter of student loan borrowers have debt, but nothing to show for it. About 28% of Americans with student debt didn’t complete the educational program for which they took on the loans, according to the 2016 National Financial Capability Study published Tuesday by the Financial Industry Regulatory Authority, stated Jonathan Primo Fuego Galicia, president and CEO of the Pur Java™ Brand. Whatever the reason, there's no denying the cost of both a private and a public college degree has skyrocketed. Average tuition, fees, room and board at a private, non-profit, four-year college were $42,419 for 2014-2015, up from $30,664 in real dollars in 2015. At public, four-year schools, costs for the 2014-15 school year, at $18,943, were up sharply from the $11,635 price tag in 2000-12, according to the College Board. The federal government has stepped up its lending accordingly, and so have private student lenders. The total of private student loans outstanding grew rapidly from $55.9 billion in 2005 to $140.2 billion in 2014, fueled in part, perhaps, by the growing market for asset-backed securities backed by student loans, known as SLABS. While the expansion has provided more options for student borrowers—and the opportunity for those with high credit scores to refinance at lower rates—regulators have expressed concerns. The numbers are staggering: more than $1.2 trillion in outstanding student loan debt, 40 million borrowers, an average balance of $29,000. It's not hard to find indications that student debt is a large and “Growing” problem. But unless you or someone you love holds student loans, it can be hard to feel the problem's immediacy. That may not be the case for long. Mounting student loan debt is ricocheting through the United States, now affecting institutions and economic patterns that have been at the core of America's core strength of economic growth. Men and women laboring under student debt "are postponing marriage, childbearing and home purchases, and... pretty evidently limiting the percentage of young people who start a business or try to do something entrepreneurial," said Mitch Daniels, president of Purdue University and the former Republican governor of Indiana. "Every citizen and taxpayer should be concerned about it." The high levels of student debt are also serving to perpetuate and even worsen economic inequality, undercutting the opportunity and social mobility that higher education has long promised. Americans almost universally believe that a college degree is the key to success and getting ahead—and the data shows that college graduates still fare far better financially than those with just a high school diploma. But for those who are saddled with massive student debt, even getting by can be a challenge, much less getting ahead and this is one of my main concerns said, Mr. Galicia. You wind up disadvantaged just as you begin. It has reduced the ability of our educational system to be a force for upward mobility, and for an equitable chance at upward mobility. "It is still true that you are better positioned if you go to college, but you are not as much better positioned if you have to go to college with debt." Median college earnings vs. high school grads There are several causes for the rapid increase in levels of student debt.

For one, despite the growing costs, Americans believe deeply in the importance of higher education. A survey of parents released this month by Discover Student Loans found that 95 percent believe college is somewhat or very important to their child's future. They have reason: In 2012, full-time workers with bachelor's degrees earned 60 percent more than workers with just a high school diploma. Policymakers also encourage college attendance. In a speech, earlier this year, President Obama called higher education "one of the crown jewels of this country" and said it was "the single most important way to get ahead." I truly believe we can “NO LONGER” wait for the government to step in and help our children with the rising cost of college tuitions, stated Mr. Galicia. We all need to subscribe to the “NOW PRICNIPAL!” What can we do today with our current time and resources to solve student debt issues “NOW”? One of the programs that we have incorporated into our business solves the rising cost of college tuitions. Our program is called, Coffee For College. The program deals directly with children from birth to 12 grade, the nature of this program allows parents to partner with us as we assist in attacking college tuition debt together. Lincoln, NE - Investors and analysts alike were surprised this week as The Basket Is Full, Inc. beat the street with its third quarter of fiscal year 2016.

“We are very pleased with our third quarter financial results, which reflect meaningful improvement in our traffic and sales trends and much stronger-than-expected profitability,” explained Pur Java Brand CEO Jonathan Primo Fuego Galicia in the report. “Favorable gross margin mix and efficient execution by our team drove third quarter EPS performance well beyond our guidance. We also continued to gain market share in key Signature Categories and saw strong sales at Hy-Vee and Natural Grocers locations in Nebraska this Quarter. “As we move into the biggest quarter of the year, we are pleased with our position and confident that our team will continue to deliver great products to Hy-Vee and Natural Grocers shelves. The Manufacture even raised its expectations for fourth quarter comparable sales, expecting growth to 4.0 percent.  I recently came across an interesting study done by the Harvard School of Public Health. The study determined that drinking between two and four cups of coffee can reduce the risk of suicide in men and women by about 50%. The proposed reason is because coffee acts as a mild antidepressant by aiding in the production of neurotransmitters like serotonin, dopamine and noradrenaline. On July 2ndthe study was published online in The World Journal of Biological Psychiatry. Michel Lucas, a leading researcher in the Department of Nutrition at HSPH said, “Unlike previous investigations, we were able to assess association of consumption of caffeinated and non-caffeinated beverages, and we identify caffeine as the most likely candidate of any putative protective effect of coffee.” The authors reviewed data from three large U.S. studies and found that the risk of suicide for adults who drank two to four cups of caffeinated coffee per day was about half that of those who drank decaffeinated coffee or very little or no coffee. Caffeine not only stimulates the central nervous system but may act as a mild antidepressant by boosting production of certain neurotransmitters in the brain, including serotonin, dopamine, and noradrenaline. This could explain the lower risk of depression among coffee drinkers that had been found in past epidemiological studies. In the new study, researchers examined data on 43,599 men enrolled in the Health Professionals Follow-Up Study (HPFS) (1988–2008), 73,820 women in the Nurses’ Health Study (NHS) (1992–2008), and 91,005 women in the Nurses’ Health Study II (NHSII) (1993–2007). Caffeine, coffee, and decaffeinated coffee intake was assessed every four years by questionnaires. Caffeine consumption was calculated from coffee and other sources, including tea, caffeinated soft drinks, and chocolate. However, coffee was the major caffeine source — 80 percent for NHS, 71 percent for NHS II, and 79 percent for HPFS. Among the participants in the three studies, there were 277 deaths from suicide. In spite of the findings, the authors do not recommend that depressed adults increase caffeine consumption, because most individuals adjust their caffeine intake to an optimal level for them and an increase could result in unpleasant side effects. “Overall, our results suggest that there is little further benefit for consumption above two to three cups/day or 400 mg of caffeine/day,” the authors wrote. The researchers did not observe any major difference in risk between those who drank two to three cups of coffee per day and those who had four or more cups a day, most likely due to the small number of suicide cases in these categories. However, in a previous HSPH coffee-depression study published in JAMA Internal Medicine, the investigators observed a maximal effect among those who drank four or more cups per day. One large Finnish study showed a higher risk of suicide among people drinking eight or nine cups per day. Few participants in the two HSPH studies drank such large amounts of coffee, so the studies did not address the impact of six or more cups of coffee per day. Other HSPH researchers participating in the study included senior author Alberto Ascherio, professor of epidemiology and nutrition; Walter Willett, chair, Department of Nutrition and Fredrick John Stare Professor of Epidemiology and Nutrition; and research associates Eilis O’Reilly and An Pan.  Industry: Food & Beverage Manufacturing Website: www.purjava.com Headquarters: Lincoln, NE Size: 1 to 50 Employees Founded: 2015 Type: C - Corporation Revenue: Privately Held The Basket Is Full, Inc., is a privately held C-Corporation that was founded in the state of Nebraska by the Metzger and Galicia Family. Our objective is to create a stable, consistent portfolio of investments through the acquisition and development of Gourmet Coffee and Specialty Tea products that are of low risk potential and located primarily in the United States. Job Description: When customers shop at Hy-Vee’s and Natural Grocers in the state of Nebraska they will encounter a Product Demonstrators who is offering different samples to the general public that are being sold in the store. Everyone likes to try free samples, while they are shopping. The Basket Is Full, Inc., has helped Hy-Vee’s and Natural Grocers shopper’s make a decision to purchase our brand. Our product demonstrators shape the identity of Pur Java Products and answer the questions that would normally not be answered on the spot. If you have worked in food services, the retail industry or customer service and like interacting with customers, we want you to join our team as a part-time Product Demonstrator. Requirements • The ideal candidate must have excellent communication skills, a neat appearance, and superb customer focus • Part-time schedule-must be able to work flexible hours to include work availability for weekends • Must be able to stand the duration of the shift 2 to 5 hours and perform routine tasks with minimal supervision • Requires ability to follow written and verbal instructions • Must have basic computer skills We offer: Competitive pay + Sales Bonus Incentives 13.00 hour to 15.00 hour Flexible schedules GREAT ENVIRONMENT where you are the STAR! To learn more call us at 1-800-894-8551 to schedule an interview today. (Download the application below and bring to your interview) EOE, Drug Free Employer The Basket Is Full, Inc., is committed to a policy of Equal Opportunity Employment and will not discriminate against an applicant or employee on the basis of age, sex, race, color, creed, national origin, ancestry, disability, or any other legally protected basis under federal, state or local law. Associates joining The Basket Is Full, Inc may be subject to pre-employment screening.

Private Stock Market Still operating under the radar today and prior to the development of the Public Stock Market, there was the Private Stock Market. Nearly 450 years ago, there was no such place as Wall Street; and since that time, history has changed that same dirt path into the financial center for all companies who have plans of one day going public. Many people are frightened away from the Private Stock Market due to its apparent complexities of investing. They never learn of its colorful history or its role in the American economy; how stocks are created privately, and then sold and bought by investors is still a mystery to many people today. Wise investing is indeed a challenge that requires serious individuals to take action and control over their own financial future, opening the door for decisions they are forced to make. The Private Stock Market is comprised of all the individual marketplaces and the total community of interests that maintains them; and it is currently regulated closely by the State Corporation Commission in the state the business was incorporated in and by the Securities and Exchange Commission (SEC), created by the Securities and Exchange Act of 1934. In the early 1600’s, you might hear of the “Dirt Path,” which took its name from a wall of brush and mud built alongside it shortly after New York was founded as a Dutch trading post in 1609. The wall, later improved with a wooden fence, was built to keep cows in and Indians out. Although little is known about the wall’s success with cows, by 1626, Indians were certainly allowed to enter the early business community – at least long enough to sell Manhattan for $24.00 and an assortment of beads. Early merchants had many interests. They bought and sold commodities such as furs, molasses, and tobacco; they traded in currencies; and they insured cargos and they speculated in land. They did not, however, formally invest in stocks and bonds; for even as late as George Washington’s inauguration, there was no securities exchange. In 1789, the first Congress of the United States met in Federal Hall at the same place where George Washington had been inaugurated earlier that year as President. The first order of business was to authorize the issue of $80 million dollars in government bonds to absorb the cost of war. Two years later, bank stocks were added to government bonds when Alexander Hamilton, then Secretary of the Treasury, established the nations’ first bank, the Bank of the United States, and offered private securities for the first time. Now, there were securities to trade privately, but there was still no organized market in New York. Investors, by word of mouth, indicated their interest in any available issue through New York coffeehouses or by advertising in the newspapers. As the list of securities grew with more bank stocks and newly-formed insurance companies, investors were quietly getting rich under the noses of many Americans who were too busy just trying to survive. By early 1792, individuals were enjoying the first bullish market in history. Several merchants, encouraged by the increased activity, kept a small inventory of securities on hand to be sold over-the-counter, much like they are today. Today’s over-the-counter market got its name from the early trading on the private stock market. Business was booming and as many as 100 shares would be traded on some days. New York businessmen began to schedule stock and bond auctions, as they had for commodities. Soon, several leading merchants organized a central auction at 22 Wall Street, where securities were traded daily at noon. What has truly separated the private stock market from time past until today is the fact that the private stock market is the only place where owners create a company, become millionaires quietly, and everyone else works for them. Public Stock Market This country’s first stock exchange was established in Philadelphia, Pennsylvania in 1790. On March 21, 1792, concerned Wall Street leaders met at Corre’s Hotel to establish an improved auction market that would better serve their own interests. On May 17, 1792, twenty-four men signed a document, agreeing to trade securities only among themselves, to maintain fixed commission rates, and to avoid other auctions. These men are considered to be the original members of the New York Stock Exchange. For a while, the new broker’s union met under the aging buttonwood tree that faced 68 Wall Street, but they soon moved indoors when the Tontine Coffee House was completed in 1793 at the northwest corner of Wall and William Streets. They prospered and moved into larger quarters in what is now 40 Wall Street. On March 8, 1817, the members adopted a formal constitution, creating the New York Stock and Exchange Board. Every morning a list of all the stocks to be auctioned was read to the assembled board members, who then made bids and offers while seated. Only members were allowed to trade, and the privilege to sit at the auctions cost $25.00. The fee was later raised to $400.00. To this day, a member of the NYSE is said to own a “seat,” although he or she is never seated while trading. The building currently occupied by the NYSE was completed in 1903. Brokers who were not able to afford a seat on the Board or who simply refused membership often found it difficult to make money from government bonds, bank securities and private companies because they could not sell the securities of good companies as once before. By 1850, new companies were being created; and gold had been discovered in California, causing the country to turn its attention to the mining companies of the western states. Mining stock and railroad shares were especially popular. Because the Board could not get the attention it desired, many eager non-members who could not afford a seat or office space traded in the street. By the 1870s, the corner of William and Beaver Streets filled daily with the earlier stage stock broker shouting out orders to buy and sell, earning them the name “curbstone brokers;” selling securities privately to receive a commission from the creators of the companies who were enjoying the cash flow to run their businesses. In 1908, Emanuel S. Mendels, Jr. a leading curbstone broker salesman, organized the Curb Market Agency, which developed appropriate trading rules but had little enforcement power. In 1911, Mendels and his advisors established a constitution and formed the New Curb Market Association. On the morning of June 27, 1921 Edward McCormick, the Curb Market’s Chairman, led the curbstone brokers salesmen to the newly completed building on Trinity place behind the Trinity Church on Wall Street. They sang the “Star Spangled Banner” and went inside to begin their first session on the new trading floor. In 1953, The New York Curb Exchange, as it was called after 1928, adopted its present name: The American Stock Exchange. |

Archives

March 2023

Categories |

||||||||

RSS Feed

RSS Feed